https://www.alliedexecutives.com/

GeoTagged, [N44.97292, E93.27363]

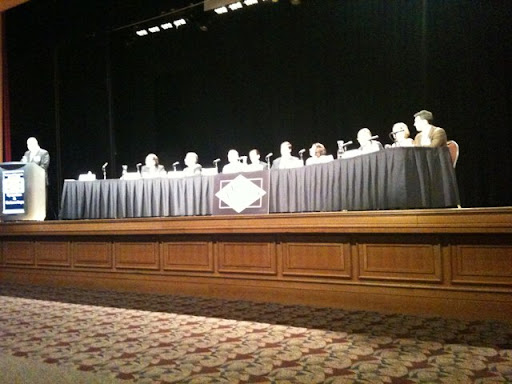

Keynote Speaker: Narayana Kocherlakota, President of The Federal Reserve Bank of Minneapolis.

Panel included:

Dean Bachelor – CEO Platinum Group

Scott J. Dongoske – President Winthrop & Weinstine

Al Gerhardt – COO Kraus-Anderson

Elliot Jaffee – TC President US Bank

Michael Lacey – CEO Digineer

Beth Kieffer Leonard – Managing Partner LBLCo

Cary Musech – managing Principles Tonka Bay Equity Partners

Jean Taylor – CEO Taylor Corp.

Scott W. Wine – CEO Polaris

John P. Palen – CEO Allied Executives

Most of the panelists predict that revenues will hold steady this year or experience some growth. The construction industry, which has 25 percent unemployment, is an exception. That industry doesn’t expect improvement until mid-2011. The technology companies see greater growth than others based on 4qtr of 2009 and 2010. Law firms believe the bottom has hit. Taylor Corp sees change as moving into more technology, as well as a move to an operational excellence model. Taupe says this is the year of revenue growth. Polaris echoes that sentiment. Polaris is focusing on sales. For Platinum group, being in a turnaround business, the phone has not stopped ringing.

How are these companies changing?

Polaris does not see cutting costs as a strategy; it is about reengineering products to offer more for less. Taylor is focusing on return on investment. Tonka Bay talked a lot about its strategic competitive advantage. Oftentimes business leaders talk about what we have rather than thinking more strategically. Tonka Bay is out looking for talent and deals. First Bank started annual business reviews with customers. Krause-Anderson believes we should never waste a good crisis.

A tactical solution is moving to teleconferencing. Winthrop is closing deals in the middle of a blizzard becase of its use of technology in video web conferencing.

Taylor is looking at partnerships with what would have been competitors in the past. They are deciding to focus on what each does well and how each side can have greater leverage.

The panel’s take on banking issues: Banks have not taken time to understand the customer. Because of this, we are all learning what we have to do to support customers. Credit is available to those that have credit-worthy ventures for those banks that have the liquidity. If you are feeling like you’re experiencing unfair treatment, it may have nothing to do with your business but it might be the bank. Talk to your bank often and early. Start planning you loan agreements 6 months ahead.

One panelist described a business that was doing a telemarketing campaign and, due to a technological glitch, called and hung up five times on a customer. The customer tried to call back, but was not able to get to through. The company was able to connect with this customer through Twitter, though. The executive who relayed this story was proud of the multiplatform coverage. He should be, but not if some of the older platforms are prone to such glitches. Not many customers would be able to look past the five hang-ups.